Fun with Math, Part 2: Credit Risk Illustrated

by Christopher Liechty | November 5, 2013

A common view of bankers is that we spend our mornings swindling the public and our afternoons rolling around in piles of money. While I can’t speak for the investment banking community, life in commercial banking is far less edgy (and far more ethical). In our business, service is essential and we operate on very narrow margins. And, as the recent crisis showed, mistakes can have devastating financial consequences.

On an almost-hourly basis, we’re asked to look a little more carefully at a deal we originally declined. Credit risk, you see, is an abstract notion to non-bankers. The customers being presented are always “good people” or really nice, or really need the money. We like to work with people like that, but it isn’t quite as simple as saying yes and hoping for the best. Credit risk is real and bad underwriting has big consequences.

Measures of profitability in banking

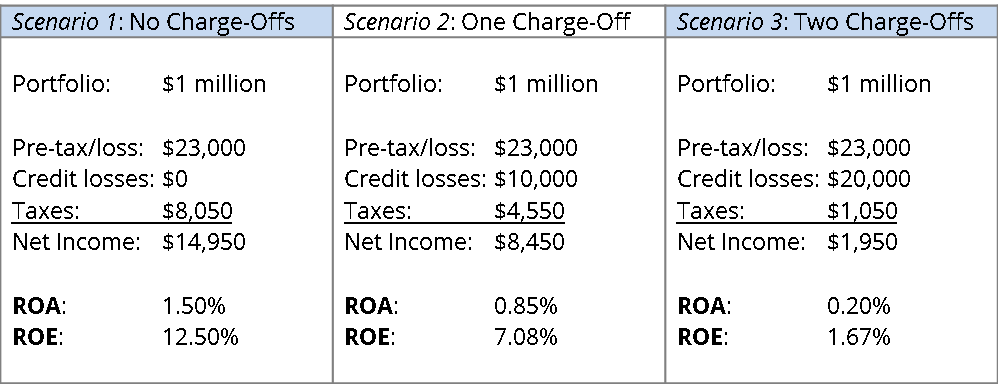

To see this, let’s go over two basic measurements of banking profitability. In commercial banking, a return on assets (ROA) of 1.5% is considered good. Because that number is an after-tax figure, the pre-tax equivalent is 2.3% assuming a 35% corporate tax rate. We’ll use that number later, too. Banks also measure their return relative to the equity – capital – invested in the company. For example, a bank with 12% capital and a 1.5% ROA is generating a 12.5% return on equity (ROE; 100%/12*1.5). You don’t need to memorize those ratios, but they’ll help make sense of the next section.

Three scenarios show the small margin of error

To see what credit risk does to a bank’s income statement, consider three scenarios. In each we’ll have a $1 million loan portfolio made up of 100 loans, each loan with a $10,000 balance. The respective scenarios have between zero and two charge offs, respectively. It doesn’t seem like there’s much difference between no loans in 100 and two loans in 100 charging off, but the effect is substantial. (For simplicity, I’ll calculate the ROA on the portfolio value, not the average assets.)

In short, on a $1 million portfolio like this, a single loss takes good performance to mediocre, decreasing the ROE from 12.5% to 7.1%. The second loss almost completely wipes out the gains for the bank, leaving it with a 1.67% ROE. Can you imagine how happy the bank’s investors will be with such miniscule returns? And you know what happens with a third charge-off that year, right? The bank loses money, management is on the hot seat, pressure increases – you know the drill.

With narrow margins like this, it is critical for a bank to make good loan decisions and to price their loans appropriately. If we can’t approve a deal for a really nice person, it doesn’t reflect that individual’s character. It’s just that we must be very careful in order to remain in business for the long haul.